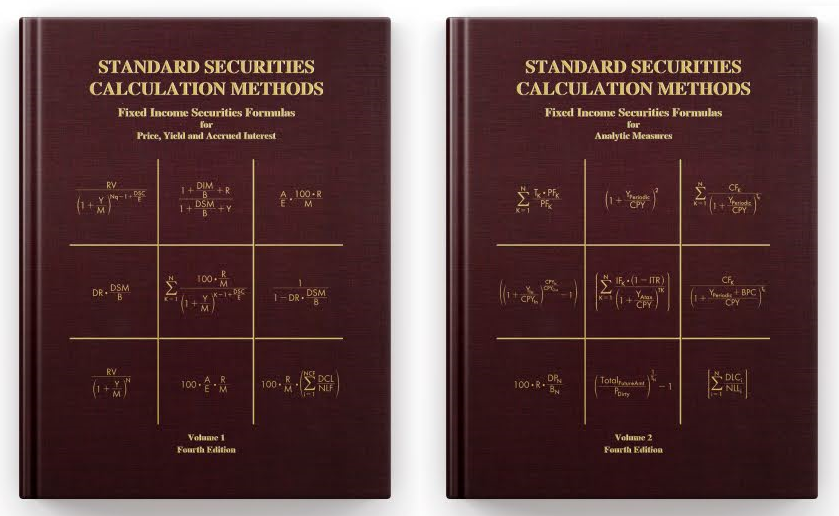

The Industry Standard Bond Calculator from the author of the Standard Securities Calculation Methods books, which have defined the industry standards for fixed income calculations for almost 50 years.

Using the same Function as a Service (FaaS) technology for performing calculations as the Standard Securities Calculations Methods subscription Benchmarking and Validation Tool this calculator

computes Price, Yield, Accrued Interest, Duration,

Modified Duration, and Convexity for U.S. Treasury, Municipal, Corporate, Agency, and bank securities

with the following structures: issued at a discount and pays only principal at maturity; pays interest and principal at maturity;

pays a fixed amount of interest periodically; stepped coupons; zero coupons; and coupon bearing certificates of deposit.

For more details on the Standard Securities Calculation Methods books, the updates and new additions, or to purchase a subscription, please visit

www.sscmfi.com