Q: Does this calculator follow industry standards?

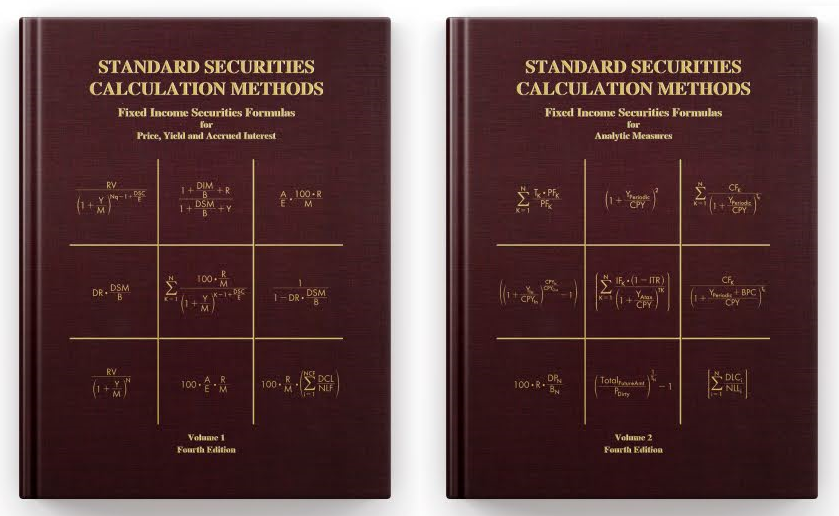

A: Yes. The calculator uses the same Function as a Service (FaaS) technology for performing calculations as the Standard Securities Calculations Methods subscription Benchmarking and Validation Calculator which can be

found at www.sscmfi.com.

Q: What types of securities are covered by the calculator?

A: The calculator covers U.S. Treasury, Municipal, Corporate, Agency, and bank securities with the following structures:

issued at a discount and pays only principal at maturity; pays interest and principal at maturity; pays a fixed amount of

interest periodically; stepped coupons; zero coupons; payment in kind; coupon bearing certificates of deposit.

Q: The calculator only does yield to maturity and not yield to call. Will yield to call be added?

A: There is a new, more fully featured, calculator that includes yield to maturity, yield to call, and

yield to worst, as well as additional calculations

available at api.sscmfi.com.

Q: Some of the payment/security types do not allow for odd first and/or last coupons. Will that capability be added?

A: There is a new, more fully featured, calculator that considers odd first and odd last coupon periods and full call schedules

available at api.sscmfi.com.

Q: Can I access the FaaS calculation capability directly so that I can incorporate the calculations into my own system?

A: Yes, all of the calculations in both volumes, plus more, are available as RESTful APIs. Please visit api.sscmfi.com for more information.